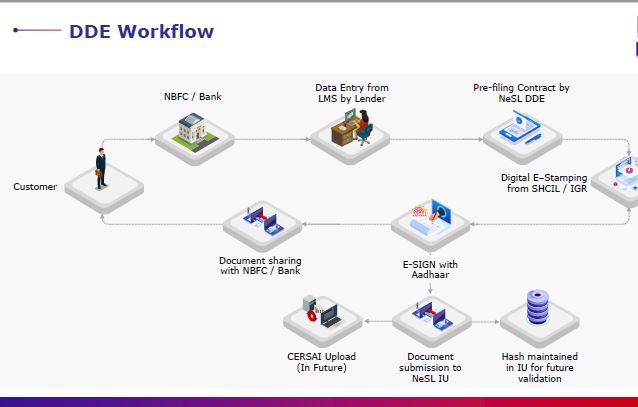

Digital Document Execution (DDE) Solution for Banks and NBFCs

Central Govt, under the aegis of the National eGovernance Service Ltd (NeSL), has introduced a fully digital loan processing solution called Digital Document Execution (DDE). The service is to be used by banks and NBFCs to issue loans via fully digital process. DDE enables the financial creditors to use paperless execution and storage of financial contracts, which will result in superior enforcement, thereby enhancing the ‘Ease of Doing Business’ especially in times where quick financing is the need of the hour for businesses.

The current workflow will take at least 5 to 15 days to complete a loan contract of a bank. This is because of various delays like below.

- Contract drafting and printing ( 7 days)

- Stamp duty procurement (3 days)

- Physical Signature from all parties (5 days)

Current Loan Processing Work flow

The advantages of switching to DDE are as below.

Seamless digital journey saves resource cost

Lenders get 65B certificate from NeSL

Digital E-Stamp procurement.

Remote E-sign is very convenient.

Dematerialization of the document execution and customer acquisition transactions

Online stamp duty payment and receipt of stamp certificate

Optimization of financial and human resources on account of the adoption of paperless green processes

Support information needs of loan exchange platform

Serve as a repository for digitally executed loan documents

Offered as a service to lending institutions which translates into minimal CAPEX based implementation