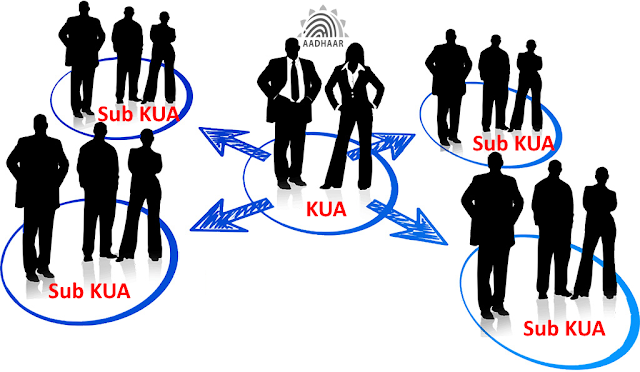

Aadhaar eKYC service is a fast, secure and convenient way to capture KYC information of customers and it is available for NBFCs and BFSI companies in India. To use this service, service providers need to register with UIDAI as KUA (KYC User Agency) or Sub KUA (Sub KYC User Agency).

KUA is a direct license holder from UIDAI and can access the eKYC service directly. Sub KUA is an entity that has an agreement with a KUA to access the eKYC service through them. Sub KUA pays a fee to the KUA for using the service.

If you are a BFSI (Banking, Financial Services and Insurance) company in India, you may be part of a group of companies that offer various products and services to your customers. For example, you may have a bank, an insurance company, a mutual fund company and a housing finance company under your group.

In such a case, you may want to use Aadhaar eKYC service for all your group companies to streamline your customer verification process and reduce your operational costs. However, registering each of your group companies as KUA can be costly and time-consuming. You will have to pay a license fee, a security deposit and an annual maintenance fee to UIDAI for each KUA registration.

A smarter way to save money on Aadhaar eKYC service is to have one of your group companies as KUA and the rest as Sub KUA under them. This way, you will only pay one license fee, one security deposit and one annual maintenance fee to UIDAI for the KUA registration. The rest of your group companies can access the eKYC service through the KUA by paying a nominal fee per transaction.

This scheme has many advantages for your group companies:

- You can leverage the existing infrastructure and technical expertise of the KUA for accessing the eKYC service.

- You can avoid duplication of efforts and resources for registering multiple KUAs with UIDAI.

- You can reduce your operational costs and increase your profitability by paying less fees for using the eKYC service.

- You can enhance your customer experience and satisfaction by offering them a seamless and hassle-free verification process using their Aadhaar number.

- You can comply with the regulatory norms and guidelines for KYC verification using Aadhaar.

To implement this scheme, you will need to follow these steps:

- Choose one of your group companies that has the highest volume of customer verification transactions as the KUA.

- Apply for the KUA registration with UIDAI by submitting the required documents and fees.

- Sign an agreement with UIDAI for accessing the eKYC service as per the terms and conditions.

- Sign an agreement with each of your group companies that want to become Sub KUAs under you.

- Provide them with the necessary technical support and training for accessing the eKYC service through you.

- Monitor and audit their transactions and compliance with UIDAI’s rules and regulations.

By following this scheme, you can save a lot of money on Aadhaar eKYC service and improve your business efficiency and customer satisfaction.

For more information contact us.

KYC, Authentication, etc. If you want to know how your enterprise can start using it, please give us a call @ 0484 2388285 or email us at info@finahub.com