Meta Description: Want to learn the

importance of eKYC for a faster banking process? Here's how eKYC enables

co-operative banks to process quick transactions and customer-related services.

image source

KYC (Know Your Customer) is one of the easiest

ways to verify a customer's identity and address. Customers must complete their

eKYC to open their bank account, investment account, fixed deposit, or any

other bank-related account. eKYC through Aadhar is the fastest process way of

customer verification.

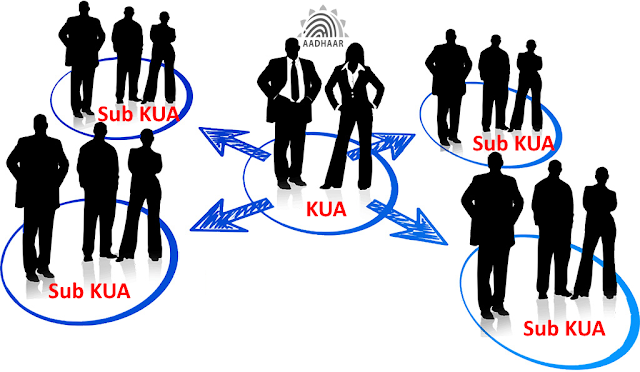

In the guidelines by the central authority, co-operative banks

are authorized to process eKYC via customer Aadhar number. The reason

behind processing eKYC is to ensure the customers are involved in fair

transactions or fair online dealings rather than in contact with any illegal

financial group. Additionally, in the updated eKYC Aadhar process using

Sub-KUA(Sub- KYC User Agency) mode, co-operative banks won't require

documentation paperwork or signatures but will follow biometric information.

image source

There are two types of eKYC available: online & offline.

Online Mode

This includes the following:

- Biometric

authentication - The customer has to scan

their finger or eyes on the biometric scanner to provide their biometric

data to UIDAI database.

- OTP

Based verification - In the process customer

submits the OTP, which is sent to the Aadhar card number for verification.

Offline Mode

This includes the following:

- QR

code authentication - Here, the verifier scans the

QR code printed on the back of the Aadhar card of the customer.

- Aadhar

XML file - In this process, the customer

has to download an XML file with their registered information and submit

it to the verifier.

Recently, the Unique Identification Authority of India (UIDAI) has enabled co-operative & NBFCs under KUA & Sub-KUA

registration to process eKYC authentication for faster customer

Aadhar verification.

Aadhar eKYC: More Efficient & Secure

image source

All co-operative banks, with certificate from the Registrar of

Cooperative Society of the respective state can use the e-KYC authentication

process once they register with UIDAI as a Sub KUA. They can collect eKYC data

from the Aadhar card holder by doing Aadhaar authentication using finger print

scanning or OTP. The advantages of using

Aadhaar eKYC for co operative banks are the following:

Quick Verification

- With

the eKYC authentication facility, customers can instantly verify

themselves at authorized KUA using their Aadhar card number. Unlike basic

KYC, eKYC verifications don't consume 10-20 minutes of customers

during verification. Additionally, it has reduced operating costs and

improved efficiency.

Paper Free Process

- As

mentioned, the eKYC process doesn't require physical document

submission for customer verification. The Sub KUA verifies the customer's

identity based on the Aadhar database. While it reduces dependencies on

paper, it also encourages customers to complete authentication in a single

attempt.

Biometric Security

- The

advanced biometric technology tightens the security measure for KYC

verification. Since UIDAI only use temper-proof data on its server, it

protects its customer identity. It reduces security breaches and only

allows access to Aadhar card holders or service providers.

Impact of Aadhar eKYC on Co-operative Banks

- Co-operative

banks must request higher authorities to use KUA authentication. Once Sub-KUA

registration is finished, banks can perform eKYC authentication and

share specific information or data of Aadhar card holders with the central

agency. The eKYC authentication facility for co-operative banks has

positively impacted the banking sector.

Banks can verify their customer data, transactions, and

additional processes faster with eKYC. Since biometric technology is available,

customers don't need to bring identity verification documents to banks. Additionally, KUA does not store

Aadhar card data; instead, they share it with authorities/service providers.

Hence, stored data in the online server is only visible to service providers

and registered Aadhar holders.

Verification through eKYC authentication is the fastest

way of Aadhar verification. Nowadays, every large banks and NBFCs follow the

eKYC authentication servers to process and open an account, fixed deposit, or

other services. It is a revolutionary attempt to make the banking process

stronger, more efficient, and hassle-free.

Ref Link:

https://uidai.gov.in/images/resource/Compendium_August_2019.pdf