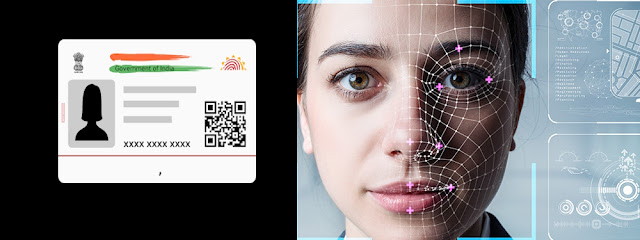

UIDAI has introduced a new authentication mechanism for doing Aadhaar EKYC. Face authentication. In which the physical face being scanned for verification and matches the one which was captured at the time of enrolment. As we found this an interesting development in the echo system, we pounced into the opportunity. We have been able to develop an android application that enables a KUA for doing Aadhaar EKYC using face authentication. The success rates were unbelievably high. We have received great response from all our customer banks about implementing face auth in production(Includes SIB, Ujjivan bank etc). Few banks like Kotak have the system in place already.